Queensway Dental will closed from 24/12 at 1pm to 02/01 at 8am. On 29/12 and 30/12 (08.30-16.30) our phone lines will be open for emergencies only. On 31/12, we will be available for emergencies only from 08.30-13.00. If you are a Queensway patient with an emergency you may call 01642554667. We wish you and your families a very Merry Christmas and a Happy New Year!

Zero-deposit dental finance plans

Spread the cost of veneers, bonding, implants and more with low-cost monthly options across the North East

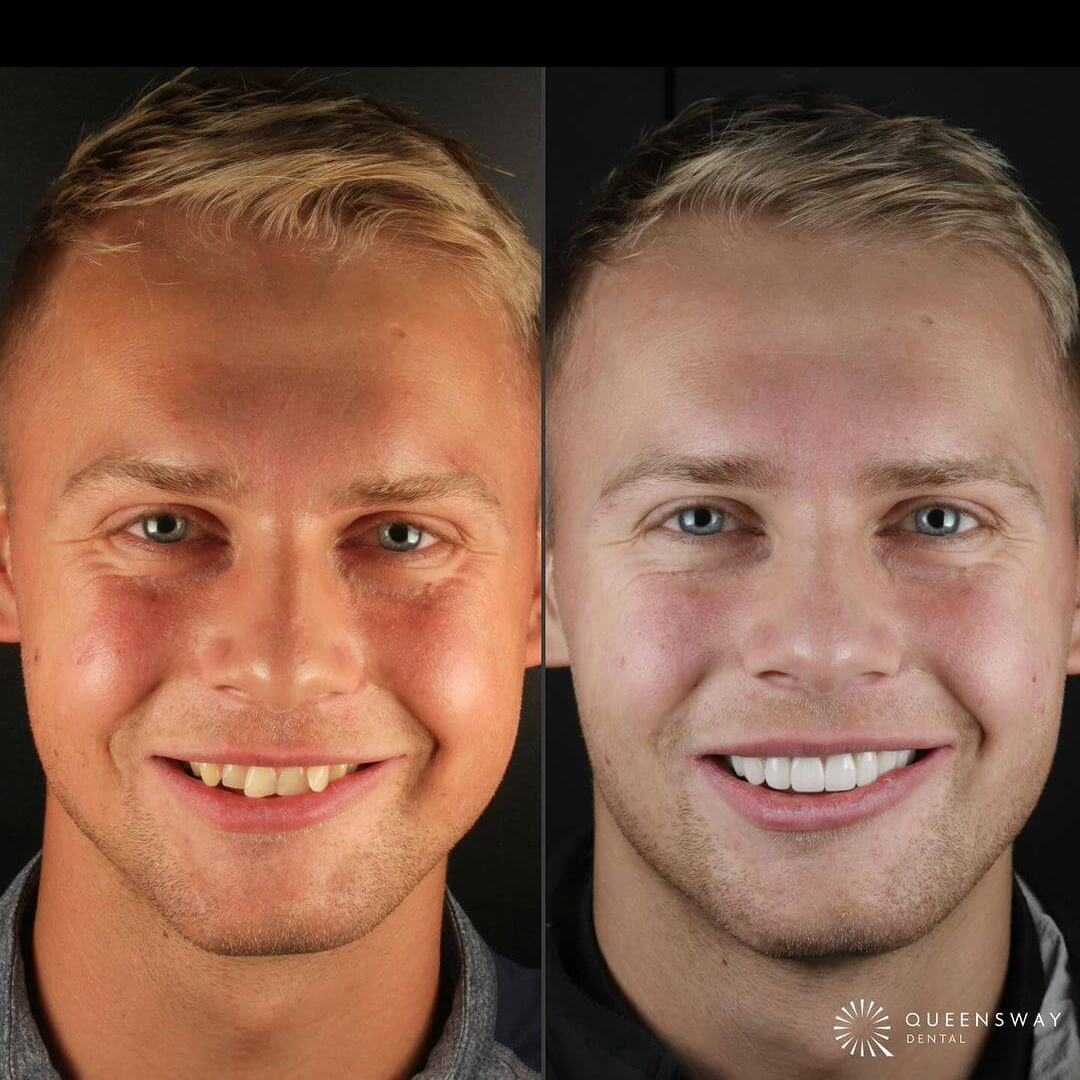

Everyone deserves a healthy, confident smile - and at Queensway Dental, we’re here to help make that possible! Whether you're considering composite bonding, veneers, dental implants or other treatments, our flexible dental finance options make it easier to access expert care without the stress of upfront costs. With 0% deposit and tailored low-cost payment plans available across our 7 North East locations, we’ll help you find a plan that fits your lifestyle and budget.

Our finance

options

We offer a few different options for payment at our practice. You can:

PAYMENT IN FULL

Payment for your treatment can be made in full by cash (up to a maximum of £8,000 per course of treatment), card, cheque or bank transfer.

ZERO-DEPOSIT INTEREST FREE FINANCE

Spread the cost of your dental treatment over 12 months interest free with V12 finance.

ZERO-DEPOSIT FINANCE

V12 finance provides a simple and accessible way to spread the cost of your dental treatment over a longer period of time. With zero deposit to pay the cost can be spread over 12, 24, 36, 48 or 60 months*.

Apply for

zero-deposit finance

Queensway Dental works with V12 Finance to provide a simple and easy way to achieve your best smile. There is zero deposit necessary, and the costs can be spread over 24, 36, 48 or 60 months*.

Example finance plan:

- Duration of Agreement: 48 months

- Representative APR: 9.9%

- Deposit Amount: £0.00

- Amount of Credit: £3220.00

- Monthly Repayment Amount: £80.86

- Total Repayable: £3881.28

*Representative Example. Amount of Credit £3,220. Total Amount Repayable £4085.35. Repayable by 48 monthly payments of £85.11. Representative 12.9% APR. Example based upon a procedure costing £3,220. Other Terms and Conditions apply. Acceptance is subject to status. Terms and conditions apply.

Queensway Group Holding Limited trading as Queensway Dental Clinic is an Introducer Appointed Representative of V12 Finance Limited, which is authorised and regulated by the Financial Conduct Authority.

Benefits of

our finance plans

There are a number of benefits to signing up to one of our payment plans, including:

- Starting treatment immediately - This reduces the risk of your dental problems becoming more expensive and severe.

- Spreading out the cost of treatment - You don’t have to worry about paying all at once.

- Paying little, if any, interest - This makes our finance plans a much better deal than the average credit card or bank loan.

- Making payments via Direct Debit - It’s easy to make payments, which will start one month after your agreement is accepted.

- Getting assistance to start - You don’t need to set up your finance plans yourself - our Treatment Advisor can help you with your application.

Apply for

dental finance today!

From veneers and composite bonding to dental implants, our payment plans make it easier to budget for your dream smile. Call our friendly team on 01642 554667 or speak with your treatment advisor to explore your finance options across our 7 North East locations.

Dentex Clinical Limited is an appointed representative of Product Partnerships Limited which is authorised and regulated by the Financial Conduct Authority. Product Partnerships Limited’s FCA registration number is 626349 and its address is Second Floor, Atlas House, 31 King Street, Leeds LS1 2HL. Product Partnerships Limited’s permitted business is to act as a Principal for a network of Appointed Representatives who arrange regulated credit facilities for customers who are purchasing goods from them.

Dentex Clinical Limited (FRN: 1003024) acts as a credit broker not a lender. We can only introduce you to Secure Trust Bank T/A V12 Retail Finance Limited (FRN: 679653) who may be able to offer you finance facilities for your purchase. We will only introduce you to this lender. We do not receive any commission for introducing customers to a finance provider. Credit is provided subject to affordability, age, and status. Minimum spend applies. Not all products offered by Secure Trust Bank PLC are regulated by the Financial Conduct Authority.